Get the free lancaster local tax form

Show details

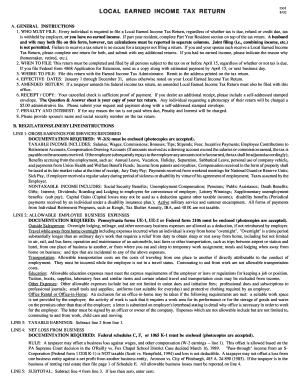

LANCASTER COUNTY EARNED INCOME TAX RETURN INSTRUCTIONS online Filing is available http://lctcb.localtaxonline.orguu GENERAL INFORMATION: This tax return covers the tax period from January 1, through

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your lancaster local tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lancaster local tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lancaster local tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lctcb local tax online form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out lancaster local tax form

How to fill out Lancaster local tax:

01

Gather all necessary documents and information, including your income statements, expense records, and any relevant forms provided by the Lancaster local tax authority.

02

Determine your filing status, which may be single, married filing jointly, married filing separately, or head of household. This will affect the tax rates and deductions you are eligible for.

03

Calculate your taxable income by subtracting any eligible deductions and exemptions from your total income. These deductions could include expenses related to education, home ownership, and medical costs, among others.

04

Use the Lancaster local tax forms or online filing system to accurately report your income, deductions, and credits. Be sure to follow all instructions carefully and double-check your entries for accuracy.

05

Calculate the amount of tax you owe by applying the appropriate tax rates to your taxable income. Lancaster local tax rates may vary depending on your income level and filing status.

06

Submit your completed tax return along with any required payments or documentation by the specified deadline. It is essential to meet all filing and payment deadlines to avoid potential penalties and interest charges.

Who needs Lancaster local tax:

01

Individuals who are residents of Lancaster and earn income within the city limits are generally required to pay Lancaster local tax. This includes both employees and self-employed individuals.

02

Non-residents who work within Lancaster may also be subject to Lancaster local tax on their earned income. However, specific rules and exemptions may apply depending on the individual's circumstances.

03

Some individuals may be exempt from Lancaster local tax, such as certain retirees, disabled individuals, or those below a certain income threshold. It is crucial to review the local tax regulations or consult with a tax professional to determine eligibility for exemptions.

Fill form : Try Risk Free

People Also Ask about lancaster local tax

What are taxes in Lancaster?

Does Lancaster PA have a local income tax?

Does Pennsylvania have local sales tax?

What is local tax in Pennsylvania?

What is city tax in Lancaster?

Does Lancaster PA have a local tax?

What is the local sales tax in Lancaster PA?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file lancaster local tax?

Any person or business located in Lancaster County, Pennsylvania, who is engaged in a taxable activity or profession is required to file local tax returns and make payments to the county. This includes businesses such as retailers, wholesalers, service providers, rental property owners, and other professions.

How to fill out lancaster local tax?

1. Gather the necessary information:

• Your Social Security number

• Your address

• The total income you earned within Lancaster County

• Any deductions or credits you may be eligible for

2. Download the appropriate forms. The forms you will need to fill out will depend on the type of income you are reporting. Visit the Lancaster County Office of Tax Assessment website to download the forms you need.

3. Fill out the forms. You will need to provide information such as your Social Security number, address, total income earned in Lancaster County, and any deductions or credits you may be eligible for.

4. Submit your forms. Once you have filled out all the necessary forms, submit them either in person or by mail to the Lancaster County Office of Tax Assessment.

5. Pay the taxes due. You will need to pay any taxes due in order for your local tax return to be complete. You can make payments online, by mail, or in person.

What is lancaster local tax?

The Lancaster local tax refers to the tax imposed by the local government in Lancaster, Pennsylvania. The specific details and rates of this tax may vary depending on the type of tax (e.g., property tax, sales tax, income tax) and the specific regulations set by the local authorities. It is advisable to consult official sources or local tax authorities for accurate and up-to-date information regarding the Lancaster local tax.

What is the purpose of lancaster local tax?

The purpose of Lancaster local tax, often referred to as the local earned income tax or LERTA, is to generate revenue for the local government of Lancaster, Pennsylvania. This tax is imposed on individuals who earn income within the jurisdiction of Lancaster, including residents and non-residents who work in the city. The revenue generated from this tax is utilized to fund various local government services and projects such as maintaining public infrastructure, funding schools, providing emergency services, and supporting community development initiatives.

What information must be reported on lancaster local tax?

The specific information that must be reported on Lancaster local tax may vary depending on the tax regulations of the specific locality. However, some common information that may need to be reported includes:

1. Personal information: Name, address, and Social Security number or taxpayer identification number.

2. Income information: Details of all sources of income earned within the local jurisdiction, which may include wages, self-employment income, rental income, and other forms of taxable income.

3. Deductions and exemptions: Any deductions or exemptions that the taxpayer is eligible for, such as allowable business expenses or personal exemptions.

4. Tax credits: Any tax credits that the taxpayer may qualify for, such as credits for child care expenses, education expenses, or energy-efficient improvements.

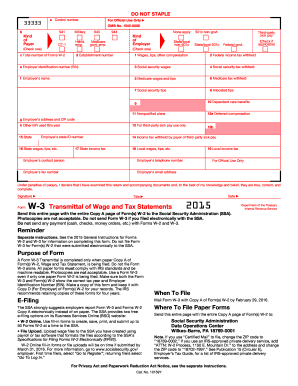

5. Withholding information: Details of any tax withheld from the taxpayer's income, such as employer withholdings or estimated tax payments.

6. Filing status: The taxpayer's marital status, which may affect their tax liability.

7. Other additional information: Depending on the specific locality, there may be additional information required, such as details of local business activities or rental properties.

It is essential to consult the specific local tax regulations and requirements for Lancaster to determine the exact information that must be reported.

How can I send lancaster local tax to be eSigned by others?

lctcb local tax online form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get lctcb localtaxonline ereporting?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific lancaster county earned income tax return and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my lctcb login in Gmail?

Create your eSignature using pdfFiller and then eSign your lancaster local tax immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your lancaster local tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lctcb Localtaxonline Ereporting is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.